Business

Hacker Steals N124,000, Empties Account After GTBank Restricts Customer’s Access

A resident of Abuja recently recounted her distressing experience involving her Guaranty Trust Bank (GTBank) account being unlawfully accessed and drained of N124,000.

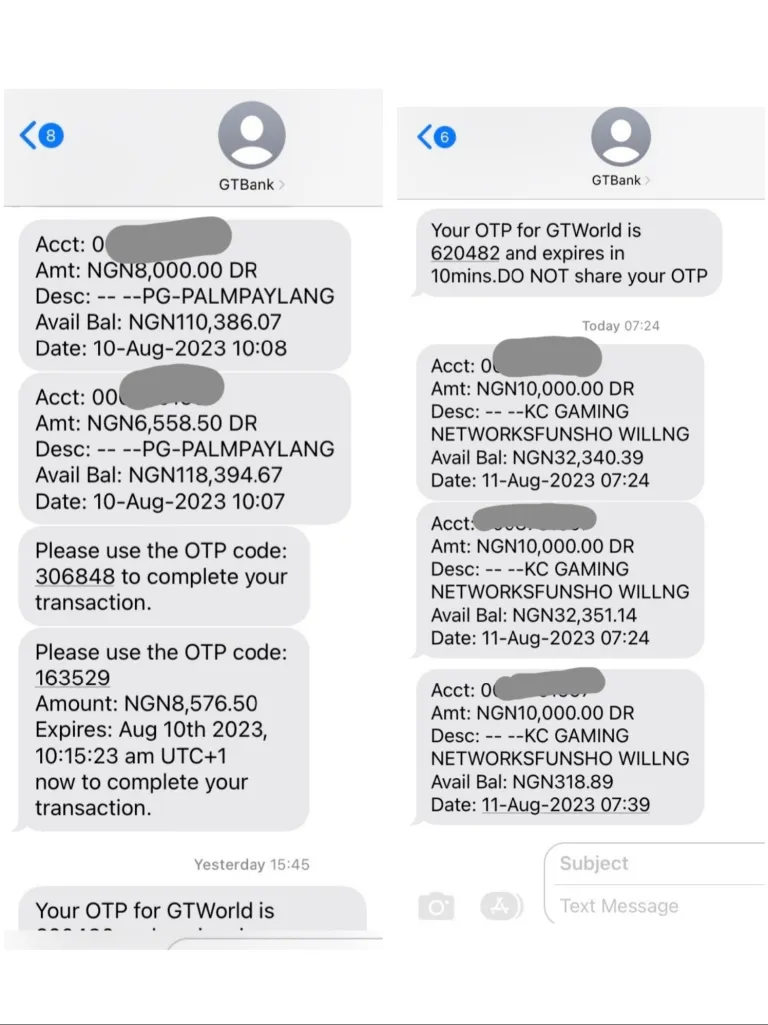

The individual, who prefers not to reveal her identity, disclosed to ThePressNG that her account was compromised on August 10 and 11. During this time, she received several text messages containing one-time passwords (OTPs). Subsequently, she was shocked to receive debit alerts totaling N23,128 for transactions she had not authorized.

Caught off guard by these unauthorized transactions, she took immediate action by blocking her account to prevent further deductions. To ensure the safety of her remaining funds, she promptly visited a GTBank branch the same day to withdraw the remaining balance from her account. However, her attempt was met with a setback when she was informed that her account had been subjected to restrictions.

Feeling a mixture of relief and confusion, she returned home, assuming that the account restriction was a security measure meant to safeguard her funds.

However, this Abuja resident’s relief was short-lived as she received several debit alerts again on August 11 until her account balance was emptied. Exactly N101,700 left her account on August 11.

She was shocked that GTBank still allowed unauthorised transactions on an account that had been restricted.

“I don’t understand how such could happen on an account that is blocked and restricted. Now all the money is gone. I lost over N124,000, and I really need my money back,” she told ThePressNG.

The GTBank customer notified the bank of these transactions and the bank informed her that she would get feedback by August 23, 2023. She has neither received a response nor a refund since then.

When ThePressNG contacted GTBank on Friday, Abiola Salami, a customer care representative wrote: “Kindly be informed that we do not disclose customer information to 3rd party, case will be reviewed accordingly.”

Investigation1 year ago

Investigation1 year agoNDLEA chiefs accused of N3.7m bribery

News1 year ago

News1 year agoFidelity Bank Staff Steals N874 Million From Customers Account With Over 22 Cloned ATM Cards

Investigation1 year ago

Investigation1 year agoPalmcredit Telesales Agents Apply Loans in Customers’ Names Without Consent – Exposed

News1 year ago

News1 year agoDS Kalu – We Will provide legal framework to boost direct foreign investments

News1 year ago

News1 year agoBritish Council Hikes IELTS Fees in Nigeria: Here’s Why

News1 year ago

News1 year agoWoman killed in Benin after overhead water tank collapses

Investigation1 year ago

Investigation1 year agoTinubu Asks US Court to Keep Chicago University Records Secret to Protect His Image from Nigerian Bloggers

News1 year ago

News1 year agoU.S. demands Niger military junta ensure safety of President-elect Bazoum